Rioja Airport Expands Air Cargo Operations

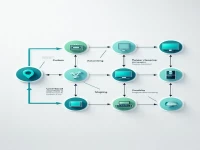

This article provides detailed information about Rioja Airport (RIJ) in Peru and highlights the West Coast's three-letter code lookup system. This system contains information on over 40,000 cities and airports worldwide, offering accurate and comprehensive air freight data to facilitate efficient and convenient international air transport operations. It also introduces West Coast's original Pinyin initial code search rule, making queries more efficient and convenient.